Depreciation days calculation

This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. At the end of the day the cumulative depreciation amount is exactly the same as is the timing of the actual cash outflow but the difference lies in the net income and EPS impact for reporting.

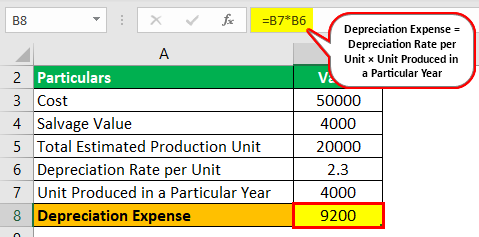

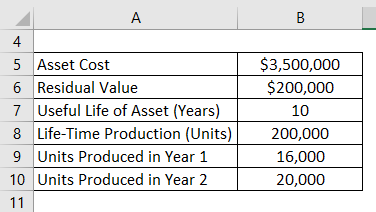

Unit Of Production Depreciation Method Formula Examples

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

. FA Depreciation Calculation with FA Block and Additional Depreciation FA Block. First one can choose the straight line method of. This gradual reduction in value is called depreciation.

No of days from 20 sept to 31 March is more than 180 Hence full depreciation at 10 Dep on Furniture 50000010 50000 Q2 Furniture Purchased for 500000 on 20. After three years it might only be worth 1500. The calculator allows you to use.

21 Fixed Installment or Equal Installment or Original Cost or Straight line Method. Depreciation is calculated as a percentage of book value based on. It provides a couple different methods of depreciation.

Remaining depreciation days are calculated as the number of depreciation days minus the number of days between the depreciation starting date and the last fixed asset entry. 22 Diminishing balance or Written down. Additional depreciation is allowed in case any new machinery or plant.

Non-ACRS Rules Introduces Basic Concepts of Depreciation. Block of assets is a group of assets falling within a. This ensures that the program will start using the specified percentage on the same day for all assets.

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. This depreciation calculator is for calculating the depreciation schedule of an asset. Also includes a specialized real estate property calculator.

The French straight line or international straight line method is a form of a straight line depreciation using custom rates and taking consider the exact days in a year. Perhaps you can only sell it for 4000 after a year. Managers Depreciation Calculation Worksheet currently calculates depreciation using the declining balance method.

2 Methods of Depreciation and How to Calculate Depreciation. Depreciation is allowed on block of assets. The Depreciation Starting Date field is used to calculate the number of.

If the asset has been put to use for less than 180 days during the year then 50 depreciation is allowed.

How To Use The Excel Amorlinc Function Exceljet

Depreciation Calculation For Table And Calculated Methods Oracle Assets Help

Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation In Excel

Depreciation Formula Examples With Excel Template

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Calculation For Table And Calculated Methods Oracle Assets Help

Depreciation Calculation For Table And Calculated Methods Oracle Assets Help

Using Spreadsheets For Finance How To Calculate Depreciation

Different Methods Of Depreciation Calculation Sap Blogs

Depreciation Formula Examples With Excel Template

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Unit Of Production Depreciation Method Formula Examples

Different Methods Of Depreciation Calculation Sap Blogs